Shielding Your Investment: Unlocking the Power of Full Ratchet Provisions in Venture Capital

100 Free HealthVC Slack Invites

Dear Subscribers,

Welcome to the latest edition of the HealthVC newsletter. In this issue, we're delving into the critical concept of Full Ratchet Provisions in venture capital. Understanding how to protect your investment from share dilution is crucial for both early-stage investors and entrepreneurs navigating the complexities of funding rounds. We’ll break down the mechanics of full ratchet provisions, explore their strategic implications, and provide insights on balancing investor interests. Whether you're an investor looking to safeguard your equity or an entrepreneur planning your next funding move, this newsletter offers a comprehensive guide to mastering Full Ratchet Provisions and securing your financial future. Join us as we explore this vital aspect of venture capital.

P.S. We're offering 100 free invites to the HealthVC Slack channel! This is a private community exclusively for paid subscribers, but the first 100 people will receive 1 year of free access. Join us to connect with industry leaders, participate in private webinars, gain access to exclusive deal flow, explore opportunities, and even secure advisory roles. Don’t miss out—claim your spot now by replying to this email saying HealthVC Slack.

Introduction

Definition of Share Dilution and Its Implications for Investors:

Share dilution occurs when a company issues additional shares of stock, which results in a reduction of the ownership percentage held by existing shareholders. This dilution impacts the relative equity stake of all existing shareholders, as the total number of shares increases while their proportion of ownership decreases. Share dilution can arise from various corporate activities, including the issuance of new shares in fundraising rounds, the exercise of stock options by employees, or the conversion of convertible securities.

For investors, share dilution carries significant implications:

Reduction in Ownership Percentage:

As new shares are issued, the ownership percentage of existing shareholders decreases. For instance, if an investor owns 10% of a company with 1 million shares, their stake would be reduced to 5% if the company issues an additional 1 million shares.

This reduction in ownership diminishes the investor's influence over corporate decisions, as their voting power is proportionally reduced.

Decreased Earnings Per Share (EPS):

Share dilution can lead to a reduction in earnings per share, which is a key metric used to assess a company's profitability. If the company's earnings remain constant but the number of outstanding shares increases, the EPS will decrease.

A lower EPS can negatively impact the company’s stock price, as investors may perceive the company to be less profitable on a per-share basis.

Impact on Share Value:

The issuance of new shares can lead to a dilution in the value of existing shares. If the market perceives that the new shares are being issued at a price lower than the intrinsic value of the existing shares, it can lead to a decline in the overall share price.

This is particularly concerning in cases where the company raises funds at a lower valuation (down round), further exacerbating the dilution impact on existing shareholders.

Loss of Control:

For significant shareholders, share dilution can result in a loss of control over the company. If the issuance of new shares leads to a shift in the balance of ownership, existing shareholders might find themselves with diminished power to influence key decisions, such as mergers, acquisitions, or changes in corporate governance.

Given these implications, investors are keenly aware of the risks associated with share dilution and seek to mitigate them through various mechanisms, one of the most common being anti-dilution provisions.

Importance of Anti-Dilution Provisions in Protecting Investor Interests:

Anti-dilution provisions are contractual mechanisms included in investment agreements to protect existing investors from the negative effects of share dilution. These provisions are particularly important in venture capital and private equity deals, where multiple rounds of funding can lead to significant dilution of early investors' equity stakes.

Preservation of Ownership Percentage:

Anti-dilution provisions ensure that existing investors maintain their ownership percentage even when new shares are issued at a lower price than they originally paid. This protection is crucial for investors who want to preserve their influence over the company and maintain the value of their investment.

Equitable Treatment of Investors:

These provisions ensure that all investors are treated fairly, particularly when new investors come in at a different valuation. By adjusting the conversion rates or share prices, anti-dilution provisions help balance the interests of early investors with those of new investors, avoiding disproportionate dilution.

Investor Confidence:

Anti-dilution provisions play a critical role in building and maintaining investor confidence. Knowing that their investment is protected against dilution makes investors more willing to commit capital, especially in early-stage companies where future fundraising rounds are likely.

Attracting Capital:

Companies that offer strong anti-dilution protections are often more attractive to investors. This can be a decisive factor in securing funding, as it assures investors that their equity stake will not be unduly diluted in future rounds.

Introduction to Full Ratchet

In venture capital, protecting early investors from the potential dilution of their ownership stakes is a critical concern. Among the various anti-dilution mechanisms available, the full ratchet provision stands out as one of the most stringent and investor-friendly options. A full ratchet anti-dilution provision ensures that if a company issues new shares at a price lower than what earlier investors paid, the conversion price of those investors' shares is adjusted downward to match the new, lower price. This mechanism is primarily applied to convertible preferred shares or options that can be converted into common stock.

For instance, if an investor originally purchased convertible preferred shares at $10 per share, and the company later issues new shares at $5 per share, a full ratchet provision allows the investor to adjust the conversion price of their shares to $5. This adjustment effectively increases the number of common shares the investor can convert their preferred shares into, thereby maintaining their ownership percentage and protecting against dilution.

Mechanics of Full Ratchet

The full ratchet provision works by adjusting the conversion price of preferred shares to the lowest price at which new shares are issued. This adjustment ensures that early investors' conversion rights are recalibrated to prevent dilution, regardless of the number of new shares issued at a lower price.

Here’s a step-by-step breakdown of how this works:

Initial Conversion Price: When preferred shares are first issued, they have a set conversion price, which is the price at which these shares can be converted into common shares. For example, with an initial conversion price of $10, each preferred share could be converted into one common share at $10.

Issuance of New Shares at a Lower Price: If the company issues new shares at a price lower than the original $10—say at $5—the full ratchet provision is triggered.

Adjustment of Conversion Price: The full ratchet provision adjusts the original conversion price from $10 down to $5, aligning it with the new share price. This adjustment allows early investors to convert their preferred shares into common shares at the new, lower price.

Increased Number of Common Shares: With the reduced conversion price, the number of common shares that early investors can obtain upon conversion increases. For instance, an investor with 1,000 preferred shares would see their potential conversion increase from 1,000 common shares (at $10) to 2,000 common shares (at $5).

Implications for Early Investors

Why Investors Demand Full Ratchet Provisions

Early investors, such as venture capitalists, often demand full ratchet provisions to safeguard their investments from the risks associated with share dilution. The motivations for seeking such protections include:

Ownership Preservation: By adjusting the conversion price to match the lowest issuance price, the full ratchet provision ensures that early investors maintain the same ownership stake in the company, even after new shares are issued.

Protection Against Down Rounds: In scenarios where the company raises funds at a lower valuation in a down round, the full ratchet provision mitigates the adverse effects on early investors by resetting their conversion price to the new lower price.

Maximizing Returns: The ability to convert preferred shares at a lower price enables early investors to acquire more common shares than initially anticipated, enhancing their potential returns if the company’s value subsequently increases.

Negotiating Power: The inclusion of a full ratchet provision in an investment agreement strengthens early investors' negotiating position, particularly in high-risk ventures where future valuations are uncertain.

Implications for Future Investors and the Company

While full ratchet provisions offer robust protection for early investors, they can create significant challenges for new investors and the company:

Increased Dilution Risk for New Investors: Full ratchet provisions shift the dilution burden onto new investors, who may find their ownership stakes significantly reduced as a result. This can discourage new investments, as potential investors may perceive the terms as overly protective of early shareholders.

Potential Impact on Valuation: The presence of a full ratchet provision can complicate the valuation process in future funding rounds. Companies might face difficulties raising capital at higher valuations, as new investors may demand lower prices to compensate for the increased dilution risk.

Strategic Challenges in Future Fundraising: The inclusion of a full ratchet provision can create long-term strategic challenges for the company. While it protects early investors, it may limit the company’s ability to attract new capital, particularly if potential investors view the provision as a barrier to fair valuation.

Comparison with Other Anti-Dilution Provisions

While full ratchet provisions provide the strongest protection against dilution, they are not the only mechanism available. Another common anti-dilution protection is the weighted average provision, which offers a more balanced approach:

Weighted Average Anti-Dilution: This method adjusts the conversion price based on a formula that considers both the price and quantity of new shares issued. Unlike the full ratchet, which resets the conversion price to the lowest new issue price, the weighted average approach provides a more moderate adjustment, spreading the impact of dilution across all shareholders.

Broad-Based Weighted Average: Includes all outstanding shares, such as common stock, options, and convertible securities, in the calculation. This typically results in a smaller adjustment to the conversion price, offering moderate protection against dilution.

Narrow-Based Weighted Average: Focuses on a narrower set of shares, such as preferred shares, in the adjustment calculation. While still providing protection, it is less aggressive than a full ratchet.

Key Differences and Strategic Considerations:

Severity of Dilution Protection: Full ratchet provides the strongest protection by resetting the conversion price to the lowest new issue price. In contrast, weighted average methods dilute the impact across a broader set of shares, resulting in a less significant adjustment.

Impact on Investor Relations: Full ratchet provisions can be perceived as overly protective of early investors, potentially complicating relations with new investors. Weighted average provisions, by offering a more balanced approach, may facilitate smoother negotiations in future rounds.

Effect on Company Valuation: The use of a full ratchet provision can make it difficult to achieve higher valuations in subsequent rounds, as new investors may be wary of the dilution risks. Weighted average provisions tend to have a more moderate impact, making them more suitable for later-stage funding.

Full ratchet anti-dilution provisions are a powerful tool for protecting early investors from the dilutive effects of subsequent fundraising rounds. By resetting the conversion price to the lowest new issue price, these provisions ensure that early investors maintain their ownership percentage, even in challenging market conditions. However, the aggressive nature of full ratchet protection can have significant implications for future fundraising efforts and investor relations, making it essential for companies to weigh the pros and cons carefully. Comparing full ratchet provisions with other anti-dilution mechanisms, such as weighted average provisions, allows companies to choose the best strategy that aligns with their long-term goals and investor expectations.

Basics of Full Ratchet

Why Investors Demand Full Ratchet Provisions

Early-stage investors often face significant risks when they commit capital to a new venture. Startups and early-stage companies are typically at a point where their future is uncertain, and their business models are still being validated. Given these high levels of risk, early investors, such as venture capitalists (VCs), seek mechanisms to protect their investments from potential future dilution. One of the most robust forms of protection is the full ratchet anti-dilution provision.

Preserving Ownership Stake:

Early investors aim to maintain their equity stake in the company even as new funding rounds occur. A full ratchet provision ensures that if subsequent investors buy in at a lower price, the original investors’ ownership percentage remains effectively unchanged by adjusting their conversion price downward. This is crucial for VCs who want to ensure that their initial investment’s value is not eroded over time.

Maximizing Upside Potential:

VCs and other early investors are motivated by the potential for high returns. A full ratchet provision safeguards their position by allowing them to acquire additional shares without additional capital outlay if the company’s valuation decreases in later rounds. This increases the number of shares they hold, thus enhancing their potential upside when the company grows or is eventually sold or goes public.

Risk Mitigation:

Investing in early-stage companies is inherently risky due to the potential for down rounds, where new shares are issued at a lower valuation. Full ratchet provisions mitigate this risk by ensuring that early investors are compensated if the company’s value decreases. This provision provides a form of insurance against the risk of valuation drops, making the investment more attractive.

Increased Negotiating Power:

Full ratchet provisions can serve as a powerful negotiating tool for early investors. By securing such a provision, they can exert more influence over the company’s future financing strategies and ensure that their interests are prioritized in subsequent rounds. This leverage is particularly important in scenarios where the company might face financial difficulties or need to raise additional capital at a lower valuation.

The Role of Full Ratchet Provisions in Venture Capital Deals and Term Sheets:

In venture capital, full ratchet anti-dilution provisions are often included in term sheets, which outline the terms and conditions of the investment. The term sheet serves as a precursor to more detailed legal agreements and is critical in setting the stage for the relationship between investors and the company.

Investor Assurance:

Full ratchet provisions are included in term sheets to provide early investors with assurance that their investments are protected. This assurance is particularly important when the company is in its early stages, and future valuations are uncertain. By including a full ratchet provision, investors can feel more confident in committing capital to the venture.

Influence Over Company Strategy:

The inclusion of a full ratchet provision in a term sheet gives investors greater control over the company’s financial strategy. It ensures that any decisions regarding future funding rounds take into account the impact on existing investors, thereby aligning the company’s interests with those of the investors.

Impact on Valuation Negotiations:

Full ratchet provisions can influence the valuation negotiations during future funding rounds. Knowing that earlier investors are protected from dilution may make it more challenging for the company to justify lower valuations in subsequent rounds. However, it also sets a clear expectation that early investors’ stakes must be considered when planning future financing.

How Full Ratchet Provisions Are Structured

Typical Contractual Language Used in Full Ratchet Provisions:

The contractual language of full ratchet provisions is crafted to clearly define the terms under which the anti-dilution protection will be triggered. While the exact wording can vary depending on the legal jurisdiction and the specifics of the deal, the following are common elements found in full ratchet provisions:

Trigger Event:

The provision typically begins by defining the event that will trigger the full ratchet protection. This usually includes any issuance of new shares at a price lower than the conversion price of the preferred shares held by the existing investors.

Example: “In the event that the Company issues additional shares of common stock at a price per share lower than the conversion price in effect immediately prior to such issuance, the conversion price of the Series A Preferred Stock shall be adjusted to such lower price.”

Adjustment Mechanism:

The clause will describe the mechanism for adjusting the conversion price. It specifies that the conversion price of the preferred shares will be reduced to match the lowest price at which new shares are issued.

Example: “The conversion price shall be adjusted to equal the lowest price per share at which the new shares are issued, with such adjustment effective immediately upon the closing of the new issuance.”

Exclusions and Limitations:

Full ratchet provisions may include specific exclusions or limitations, such as the exclusion of certain types of equity issuances (e.g., employee stock options or shares issued in a merger or acquisition).

Example: “The foregoing adjustment shall not apply to the issuance of shares under the Company’s equity incentive plans or in connection with a bona fide business acquisition.”

Notice Requirements:

The provision may require the company to provide notice to the investors when a new issuance occurs that could trigger the full ratchet adjustment.

Example: “The Company shall provide written notice to the holders of Series A Preferred Stock within ten (10) days of any issuance of common stock at a price lower than the current conversion price.”

How Full Ratchet Provisions Are Incorporated into Investment Agreements:

Full ratchet provisions are typically incorporated into investment agreements through a series of steps:

Term Sheet Negotiation:

The discussion of a full ratchet provision begins during the negotiation of the term sheet. Here, the investor and the company agree on the key terms of the investment, including the anti-dilution protection. This sets the foundation for the detailed legal agreements that follow.

Drafting of the Shareholders’ Agreement:

Once the term sheet is agreed upon, the full ratchet provision is included in the shareholders’ agreement. This agreement outlines the rights and obligations of the shareholders, including how the conversion price will be adjusted if new shares are issued at a lower price.

Inclusion in the Certificate of Incorporation:

The full ratchet provision may also be reflected in the company’s certificate of incorporation or articles of association. These documents detail the rights attached to the different classes of shares, including the preferred shares held by early investors. The full ratchet clause is embedded in the conversion rights section, ensuring it is legally enforceable.

Board Resolutions and Approvals:

When new shares are issued, the company’s board of directors typically passes a resolution to approve the issuance. The board resolution should acknowledge the potential triggering of the full ratchet provision and outline the steps to adjust the conversion price as per the investment agreements.

Execution and Enforcement:

After the issuance of new shares, the full ratchet provision is enforced by recalculating the conversion price and adjusting the number of common shares that preferred shareholders can receive upon conversion. This process is typically managed by the company’s legal and financial teams, with oversight from the board and the investors.

Potential Downsides for New Investors

Analysis of How Full Ratchet Provisions Can Disadvantage New Investors:

While full ratchet provisions provide robust protection for early investors, they can create significant challenges for new investors, potentially making them less willing to participate in subsequent funding rounds. Some of the key disadvantages for new investors include:

Increased Dilution Risk:

Full ratchet provisions shift the burden of dilution onto new investors. Since the earlier investors are protected from dilution, the new investors end up with a smaller percentage of ownership than they might have anticipated, reducing their influence and control over the company.

Perceived Unfairness:

New investors might perceive the full ratchet provision as overly protective of early investors, creating a sense of unfairness in the distribution of ownership and value. This perception can lead to difficulties in negotiating terms with new investors, who may demand concessions or higher returns to compensate for the increased risk.

Lowered Confidence in Valuation:

The existence of a full ratchet provision can signal to new investors that the company’s valuation is unstable or potentially inflated. Knowing that earlier investors are protected from a valuation drop may lead new investors to question the true value of the company and hesitate to invest.

Complexity in Deal Structuring:

Full ratchet provisions add complexity to the structuring of investment deals. New investors must carefully consider the impact of the provision on their equity stake and how it might affect future fundraising rounds. This complexity can lengthen negotiation times and increase legal and due diligence costs.

Potential Impact of Full Ratchet on Future Funding Rounds:

The inclusion of a full ratchet provision can have far-reaching implications for future funding rounds, potentially affecting the company’s ability to attract new capital and negotiate favorable terms.

Chilling Effect on New Investment:

The presence of a full ratchet provision can deter potential investors from participating in future funding rounds. Investors who understand the implications of full ratchet protection may be reluctant to invest, knowing that their equity could be significantly diluted if earlier investors are protected in a down round.

Increased Cost of Capital:

To offset the risks associated with full ratchet provisions, new investors may demand higher returns or more favorable terms, such as lower share prices or additional protective provisions. This can increase the cost of capital for the company, making future fundraising rounds more expensive.

Challenges in Achieving Up Rounds:

If a company has previously issued shares with full ratchet protection, it may face difficulties in achieving an up round (a funding round at a higher valuation) due to the dilutive effects on new investors. The need to protect earlier investors can create a ceiling on the valuation, limiting the company’s ability to raise capital at a higher price.

Potential for Shareholder Conflict:

The use of full ratchet provisions can create tension between different classes of shareholders. New investors may feel that their interests are being subordinated to those of the early investors, leading to conflicts that could disrupt the company’s governance and strategic direction.

Full ratchet anti-dilution provisions are a powerful tool for protecting early investors from the risks of share dilution, ensuring that they can maintain their ownership percentage even in the face of lower valuations in subsequent funding rounds. However, these provisions come with significant trade-offs, particularly for new investors, who may face increased dilution risk, perceived unfairness, and a more complex deal structure. The impact of full ratchet provisions on future funding rounds can be substantial, potentially deterring new investment, increasing the cost of capital, and creating challenges in achieving higher valuations. As such, both companies and investors must carefully weigh the benefits and drawbacks of full ratchet provisions when structuring investment agreements and planning for future financing.

Example of Share Dilution

To understand the importance of anti-dilution provisions like full ratchet, it’s essential to first grasp what happens when such protections are not in place. This section will walk through a detailed scenario illustrating how share dilution can negatively impact early investors in the absence of any anti-dilution provisions.

Scenario Overview:

Imagine a startup, BioTech Innovations, that initially raises $5 million in a Series A funding round. In this round, the company issues 1 million shares at $5 per share. An early investor, VC Firm Alpha, purchases 200,000 shares for $1 million, securing a 20% ownership stake in the company.

Initial Company Valuation:

Total Shares Outstanding: 1 million shares

Price Per Share: $5

Company Valuation: $5 million

VC Firm Alpha’s Ownership Percentage: 20% (200,000 shares out of 1 million)

VC Firm Alpha’s Investment: $1 million

Earnings Per Share (EPS): Suppose the company generates $500,000 in net income; the EPS is $0.50 ($500,000 / 1 million shares).

Now, assume BioTech Innovations has grown but requires additional capital to fund a new product development project. The company decides to raise another $5 million through a Series B funding round. However, due to market conditions or other factors, the company’s valuation has not increased as expected. To attract new investors, the company issues new shares at a reduced price of $2.50 per share.

Series B Funding Round:

New Shares Issued: 2 million shares at $2.50 per share

Total Shares Outstanding After Series B: 3 million shares (1 million from Series A + 2 million new shares)

New Company Valuation: $7.5 million (3 million shares x $2.50 per share)

VC Firm Alpha’s Ownership Percentage After Dilution: 6.67% (200,000 shares out of 3 million)

VC Firm Alpha’s Investment: Still $1 million, but now represents a smaller stake in a larger pool of shares.

Impact of Dilution Without Full Ratchet Provisions:

Reduction in Ownership Percentage:

Before the Series B round, VC Firm Alpha held 20% of the company. After the Series B round, without anti-dilution protection, VC Firm Alpha’s ownership percentage drops to 6.67%. This dilution significantly reduces VC Firm Alpha’s influence over company decisions, as their voting power is diminished.

Decreased Voting Rights:

Voting rights in many companies are tied directly to the percentage of ownership. With the dilution, VC Firm Alpha’s voting power has decreased from 20% to 6.67%, meaning they have less say in key business decisions, including future funding rounds, mergers, acquisitions, and strategic direction.

Lower Earnings Per Share (EPS):

Assuming BioTech Innovations continues to generate $500,000 in net income, the EPS decreases as the total number of shares increases. Before dilution, the EPS was $0.50 ($500,000 / 1 million shares). After dilution, the EPS falls to approximately $0.167 ($500,000 / 3 million shares). This drop in EPS can reduce the perceived value of the company’s shares and make them less attractive to investors.

Impact on Future Exit Opportunities:

The reduction in ownership and voting power can also affect VC Firm Alpha’s return on investment in the event of an exit, such as a sale or IPO. With a smaller ownership stake, the returns from any sale of the company would be significantly lower for VC Firm Alpha, reducing the overall attractiveness of their initial investment.

Summary of Dilution Effects Without Full Ratchet:

Ownership Percentage: Reduced from 20% to 6.67%

Voting Rights: Significantly diminished, reducing influence over company decisions.

Earnings Per Share (EPS): Decreased from $0.50 to $0.167, potentially lowering the perceived value of shares.

Investment Value: While VC Firm Alpha’s initial investment remains the same, its value relative to the company’s total shares is significantly diminished.

This scenario highlights how share dilution can erode the value and influence of early investors when no anti-dilution protections, such as full ratchet provisions, are in place.

Example of Full Ratchet

Detailed Scenario Illustrating Full Ratchet in Action

To understand the practical application of a full ratchet anti-dilution provision, let’s walk through a hypothetical scenario involving a startup called TechVision Inc. This company is developing innovative AI-driven software solutions and has attracted the interest of venture capitalists.

Initial Funding Round:

Series A Details:

Date: January 2022

Amount Raised: $5 million

Price Per Share: $10

Total Shares Issued in Series A: 500,000 shares

Total Shares Outstanding Post-Series A: 1 million shares (including founder shares)

Investor: VC Firm Alpha purchases 200,000 shares for $2 million, securing a 20% ownership stake in TechVision Inc.

At the time of this Series A round, the startup is valued at $10 million (1 million shares x $10 per share). Given the high-risk nature of early-stage investments, VC Firm Alpha negotiates for a full ratchet anti-dilution provision to protect its equity stake in the event of a down round.

Subsequent Funding Round:

A year later, in January 2023, TechVision Inc. needs additional capital to continue product development and scale its operations. However, due to a downturn in the technology sector and slower-than-expected product adoption, the company’s valuation has not grown as anticipated. To attract new investors, TechVision Inc. decides to raise $5 million in a Series B round at a reduced price of $5 per share.

Series B Details:

New Shares Issued: 1 million shares at $5 per share

Total Shares Outstanding Post-Series B: 2 million shares (including previous shares)

New Valuation: $10 million (2 million shares x $5 per share)

Investor: VC Firm Beta purchases 500,000 shares for $2.5 million, representing a 25% stake in TechVision Inc.

Impact of Full Ratchet Provision:

The issuance of shares at $5 each in the Series B round triggers the full ratchet provision negotiated by VC Firm Alpha during the Series A round. According to this provision, the conversion price of VC Firm Alpha’s preferred shares must be adjusted to match the new, lower share price.

Original Conversion Price: $10 per share

New Series B Price: $5 per share

Adjusted Conversion Price: $5 per share (full ratchet adjustment)

With the conversion price adjusted to $5, VC Firm Alpha can now convert its 200,000 Series A preferred shares at the new lower price. This adjustment effectively doubles the number of common shares they can convert into:

Before Full Ratchet Adjustment: 200,000 preferred shares convertible into 200,000 common shares at $10 per share.

After Full Ratchet Adjustment: 200,000 preferred shares now convertible into 400,000 common shares at $5 per share.

Outcome for Initial Investors

How the Full Ratchet Provision Protects the Initial Investors’ Equity Stake:

The full ratchet provision ensures that VC Firm Alpha’s investment is protected from the dilution effects of the down round. By adjusting the conversion price to $5, VC Firm Alpha can maintain its ownership percentage in TechVision Inc., even though new shares have been issued at a lower price. Here’s how this protection plays out:

Ownership Percentage Before Series B: VC Firm Alpha held 20% of the company (200,000 shares out of 1 million).

Ownership Percentage After Series B Without Full Ratchet: Without protection, VC Firm Alpha’s stake would have been diluted to 10% (200,000 shares out of 2 million).

Ownership Percentage After Series B With Full Ratchet: With full ratchet protection, VC Firm Alpha effectively owns 400,000 shares out of 2.2 million total shares (original 1 million shares + 1 million new shares + 200,000 additional shares from full ratchet adjustment), maintaining approximately 18.18% ownership.

Potential Effects on the Company’s Equity Structure and New Investors:

While the full ratchet provision effectively protects the initial investors, it has significant implications for the company’s equity structure and the new investors involved in the Series B round.

Dilution Shifted to New Investors:

The dilution that would have affected VC Firm Alpha is instead shifted to the new Series B investors. VC Firm Beta, which initially purchased 500,000 shares representing 25% ownership, now sees its stake reduced due to the increased total share count after the full ratchet adjustment.

Revised Ownership for VC Firm Beta: VC Firm Beta’s stake is reduced from 25% to approximately 22.73% (500,000 shares out of 2.2 million total shares).

Increased Share Count:

The company’s total number of shares outstanding increases more than expected due to the full ratchet adjustment. This could complicate future fundraising efforts, as new investors may be concerned about the potential for further dilution, especially if additional down rounds occur.

New Total Shares Outstanding: 2.2 million shares post-adjustment (including additional shares issued to VC Firm Alpha).

Potential Impact on Company Valuation:

The presence of a full ratchet provision can signal to the market and future investors that the company’s valuation might be more vulnerable to fluctuation. This perception could make it more challenging to raise funds at a higher valuation in the future, as potential investors may demand better terms to offset the risk of dilution.

Investor Relations and Negotiations:

The use of a full ratchet provision can create tension between different classes of investors. New investors, like VC Firm Beta, might feel disadvantaged by the protection afforded to earlier investors, potentially leading to tougher negotiations in future funding rounds.

It could also affect the relationship between the company and its investors, as management may have to navigate conflicting interests between protecting early backers and attracting new capital.

Summary of the Full Ratchet Impact:

VC Firm Alpha: Maintains a strong equity position and minimizes dilution, preserving the value of its initial investment.

VC Firm Beta: Experiences unexpected dilution, reducing the value of its new investment and complicating future returns.

TechVision Inc.: Faces a more complex equity structure and potential challenges in future fundraising due to investor concerns about dilution and valuation stability.

While full ratchet provisions provide robust protection for early investors like VC Firm Alpha, they can introduce significant complexities and challenges for the company and its new investors. Understanding these dynamics is crucial for both entrepreneurs and investors as they navigate the intricate landscape of venture capital financing.

Other Anti-Dilution Provisions

In the realm of venture capital and private equity financing, protecting investors from the dilutive effects of future fundraising rounds is paramount. While the full ratchet provision is one of the most stringent anti-dilution mechanisms, there are alternative provisions that offer a more balanced approach between investor protection and company flexibility. This section delves into the narrow-based and broad-based weighted average anti-dilution provisions, exploring their mechanics, applicability, and comparative advantages.

Overview of Alternative Provisions

1. Weighted Average Anti-Dilution Provisions:

Unlike the full ratchet provision, which resets the conversion price of preferred shares to the lowest price at which new shares are issued, weighted average provisions adjust the conversion price based on a formula that considers both the price and quantity of new shares issued. This method offers a middle ground, providing protection to investors while mitigating the harsh dilutive impact on the company's equity structure.

There are two primary types of weighted average provisions:

Narrow-Based Weighted Average

Broad-Based Weighted Average

Each variant employs a different scope of shares in its calculation, leading to varying degrees of dilution protection.

Narrow-Based Weighted Average

Explanation of How Narrow-Based Weighted Average Provisions Work:

The narrow-based weighted average anti-dilution provision adjusts the conversion price of preferred shares by considering a limited set of shares in its calculation, typically focusing only on outstanding preferred shares. This approach provides more significant protection to preferred shareholders compared to the broad-based method but is less aggressive than the full ratchet provision.

Formula:

The adjusted conversion price (CP2) is calculated as follows:

Where:

CP1: Original conversion price.

A: Total number of shares outstanding before the new issuance (excluding options, warrants, and other convertible securities).

B: Total consideration received by the company from the new issuance divided by CP1.

C: Number of new shares issued in the down round.

Key Characteristics:

Scope of Shares: Focuses narrowly on existing preferred shares, excluding common stock equivalents like options or warrants.

Degree of Protection: Offers more protection to preferred shareholders than the broad-based method due to the narrower share base considered.

Scenario Illustrating Narrow-Based Weighted Average:

Assumptions:

Initial Setup:

Total Preferred Shares Outstanding (A): 1,000,000

Original Conversion Price (CP1): $10

Down Round Details:

New Shares Issued (C): 500,000

Price Per New Share: $5

Total Consideration Received (B x CP1): $2.5 million

Calculation:

Outcome:

The adjusted conversion price is $8.33, which is higher than the $5 price of the new shares, indicating partial protection against dilution.

Scenarios Where Narrow-Based Weighted Average Provisions Are Most Effective:

Early-Stage Companies: Where the capital structure is relatively simple, and the number of convertible securities is low.

Investor-Favored Deals: Where investors have significant negotiating power to demand stronger anti-dilution protection without imposing the rigidity of a full ratchet.

Moderate Down Rounds: Situations where the decrease in share price is not drastic, making the narrow-based method sufficient to safeguard investor interests.

Broad-Based Weighted Average

Explanation of Broad-Based Weighted Average Provisions and Their Broader Applicability:

The broad-based weighted average anti-dilution provision considers a wider range of shares in its calculation, including all outstanding common stock, preferred stock, and common stock equivalents like options, warrants, and convertible securities. This inclusivity results in a more diluted adjustment to the conversion price, offering a balanced approach between protecting investors and maintaining company attractiveness to future investors.

Formula:

The adjusted conversion price (CP2) is calculated as:

Where:

CP1: Original conversion price.

A: Total number of shares outstanding before the new issuance (including all common stock equivalents).

B: Total consideration received by the company from the new issuance divided by CP1.

C: Number of new shares issued in the down round.

Key Characteristics:

Scope of Shares: Includes a broad base of all existing shares and convertible securities.

Degree of Protection: Provides moderate protection, less than narrow-based, but promotes fairness and company flexibility.

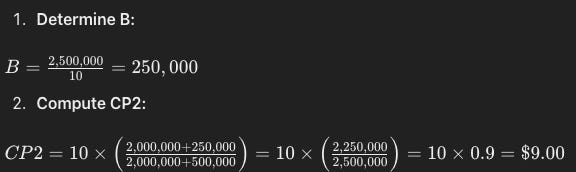

Scenario Illustrating Broad-Based Weighted Average:

Assumptions:

Initial Setup:

Total Shares Outstanding Including Equivalents (A): 2,000,000

Original Conversion Price (CP1): $10

Down Round Details:

New Shares Issued (C): 500,000

Price Per New Share: $5

Total Consideration Received (B x CP1): $2.5 million

Calculation:

Outcome:

The adjusted conversion price is $9.00, offering less protection than the narrow-based method but maintaining a balance that favors both investors and the company's future fundraising prospects.

Comparison of Effectiveness Between Narrow-Based and Broad-Based Provisions in Different Contexts:

Investor Protection: Narrow-based offers stronger protection due to the limited share base considered, leading to a lower adjusted conversion price compared to broad-based.

Company Flexibility: Broad-based is more company-friendly, as it results in less severe dilution for new investors, facilitating smoother future funding rounds.

Applicability: Broad-based is often preferred in later-stage investments or in companies with complex capital structures involving numerous convertible securities.

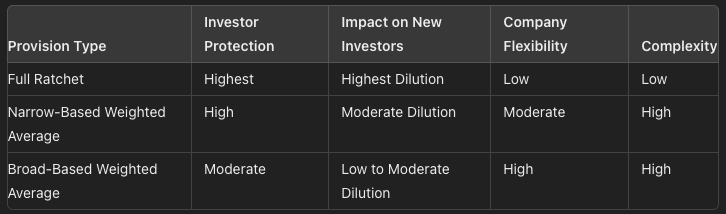

Pros and Cons of Each Method

A comparative analysis of the full ratchet, narrow-based weighted average, and broad-based weighted average provisions elucidates their respective benefits and drawbacks.

1. Full Ratchet

Pros:

Maximum Investor Protection: Resets the conversion price to the lowest price at which new shares are issued, ensuring investors maintain their ownership percentage.

Simplicity: The mechanism is straightforward, with clear outcomes for investors.

Cons:

Harsh Dilution for New Investors: Places the dilution burden squarely on new investors, potentially deterring future investment.

Potentially Detrimental to Company: May complicate future fundraising efforts and impact company valuation negatively.

Investor Relations: Could create tension between existing and new investors due to perceived inequity.

2. Narrow-Based Weighted Average

Pros:

Balanced Protection: Offers significant protection to preferred shareholders without being as severe as the full ratchet.

Attractive to Investors: Especially favorable in early-stage investments where investors seek strong safeguards.

Cons:

Complexity: The calculation is more intricate, requiring detailed knowledge of the company's capital structure.

Potential Investor Disparity: May favor certain investors over others, leading to possible conflicts.

3. Broad-Based Weighted Average

Pros:

Fairness: Balances the interests of existing and new investors, promoting equitable treatment.

Facilitates Future Fundraising: By mitigating harsh dilution, it maintains the company's attractiveness to prospective investors.

Reflects Total Capital Structure: Considers all forms of equity and convertible securities, providing a comprehensive adjustment mechanism.

Cons:

Less Investor Protection: Offers the least protection among the three, which may be a concern for risk-averse investors.

Complexity in Calculation: Similar to narrow-based, it requires a detailed understanding of the entire capital structure.

Summary Table:

Strategic Considerations:

Investor Negotiating Power: Stronger investors may push for full ratchet provisions, while companies may advocate for a broad-based weighted average to preserve future fundraising options.

Stage of Company Development: Early-stage companies might acquiesce to stricter provisions to secure funding, whereas mature companies may have the leverage to insist on more balanced terms.

Market Conditions: In bullish markets, companies might resist stringent anti-dilution provisions, whereas in bearish conditions, investors may have the upper hand.

The choice of anti-dilution provision hinges on a delicate balance between protecting investor interests and ensuring the company's long-term viability. While full ratchet provisions offer unparalleled protection for investors, their potential to hinder future investments necessitates careful consideration. Weighted average provisions, both narrow and broad-based, provide alternative pathways that strive to balance these competing interests, with their selection contingent upon the specific context of the investment and the strategic objectives of the stakeholders involved.

Strategic Considerations for Entrepreneurs and Investors

When to Use Full Ratchet Provisions

Full ratchet provisions are most beneficial in specific strategic situations where early-stage investors face significant risks, and the potential for share dilution in future rounds is high. These provisions provide maximum protection by ensuring that the conversion price of preferred shares is adjusted to the lowest price at which new shares are issued, thereby safeguarding the investor’s ownership percentage.

High-Risk Early-Stage Investments:

Uncertainty in Valuation: When a company is in its infancy, valuations are often highly speculative and subject to significant fluctuations. In such scenarios, early investors may demand full ratchet provisions to protect themselves from the risk of substantial dilution if future funding rounds occur at lower valuations.

Unproven Business Models: Startups with unproven or disruptive business models carry higher risks. Investors in these ventures may push for full ratchet provisions as a safeguard against the volatility associated with the company's early growth stages.

Anticipated Down Rounds:

Market Volatility: In industries prone to market volatility, such as technology or biotech, companies might face down rounds where new shares are issued at a lower valuation than previous rounds. Full ratchet provisions are crucial in these cases to protect early investors from losing their equity stake.

Fundraising Challenges: Companies that anticipate difficulties in raising future rounds at higher valuations due to market conditions or internal challenges might include full ratchet provisions to reassure early investors.

Investor Negotiating Leverage:

High Bargaining Power: Investors with substantial bargaining power, such as those providing significant capital or strategic value, may leverage their position to secure full ratchet provisions. This is especially true when they perceive a high risk of valuation decline or when investing in highly competitive sectors where other investors might not offer such protections.

Considerations for Entrepreneurs When Negotiating Full Ratchet Terms:

While full ratchet provisions offer strong protection for investors, they can also impose significant constraints on the company’s ability to attract future investments and maintain a balanced capital structure. Entrepreneurs must weigh several considerations when negotiating these terms:

Impact on Future Fundraising:

Dilution Risks: Entrepreneurs should be aware that full ratchet provisions can make future fundraising rounds more challenging. New investors may be discouraged by the potential for significant dilution and might demand better terms or avoid investing altogether.

Valuation Pressure: Companies may face pressure to maintain or increase their valuation in subsequent rounds to avoid triggering the full ratchet provision, which could lead to inflated valuations that are difficult to sustain.

Investor Relations:

Transparency: It is crucial for entrepreneurs to maintain transparency with all investors, explaining the implications of full ratchet provisions and how they will be managed. This helps build trust and mitigates the risk of conflicts arising from perceived inequities in investor treatment.

Negotiation Flexibility: Entrepreneurs might consider negotiating the scope of the full ratchet provision. For instance, they could propose a sunset clause, limiting the duration of the provision, or suggest applying it only under certain conditions, such as extreme valuation drops.

Strategic Trade-offs:

Long-Term Growth vs. Immediate Protection: Entrepreneurs need to balance the need for securing early capital with the long-term implications of full ratchet provisions. While such provisions might be necessary to secure initial investment, they can create hurdles in subsequent rounds, potentially stalling growth if future investors are deterred by the terms.

Balancing Interests Between Early and New Investors

Balancing the interests of early and new investors is a critical aspect of venture capital financing. While full ratchet provisions protect early investors from dilution, they can place a disproportionate burden on new investors, leading to potential conflicts and challenges in securing future funding.

Equitable Treatment of Investors:

Perception of Fairness: New investors may view full ratchet provisions as overly protective of early investors, particularly if these provisions lead to significant dilution for new shareholders. Ensuring that all investors perceive the terms as fair is crucial for maintaining a positive investor relationship and avoiding conflicts.

Investor Cohesion: Companies must manage the relationships between different classes of investors to prevent divisions that could disrupt the company’s governance or strategic direction. Balancing protection with fairness can help align the interests of all parties and foster a cohesive investment environment.

Structuring Investments to Minimize Conflict:

Tiered Anti-Dilution Provisions: One strategy for balancing interests is to implement tiered anti-dilution provisions that offer varying levels of protection based on the investment stage or risk profile. For instance, early investors might receive full ratchet protection, while later investors could be offered weighted average protection.

Conditional Ratchet Provisions: Entrepreneurs might negotiate conditional ratchet provisions that are triggered only under specific circumstances, such as a significant drop in valuation. This approach can provide early investors with necessary protection while reducing the likelihood of conflict with new investors.

Strategies for Managing Potential Conflicts Between Investor Groups:

Open Communication Channels:

Regular Updates: Keeping all investors informed about the company’s progress, challenges, and future fundraising plans can help mitigate concerns and foster a collaborative environment.

Stakeholder Meetings: Hosting regular meetings with representatives from different investor groups can provide a platform for discussing concerns, aligning interests, and addressing potential conflicts before they escalate.

Balancing Equity Distribution:

Equity Incentives: Offering new investors additional incentives, such as warrants or options, can help offset the perceived disadvantages of full ratchet provisions. This approach can make the investment more attractive despite the presence of strict anti-dilution protections.

Convertible Securities: Utilizing convertible securities that offer flexible conversion terms can provide a middle ground, balancing the needs of both early and new investors by offering protection without the rigidity of a full ratchet.

Legal and Advisory Support:

Legal Counsel: Engaging experienced legal counsel to draft clear and equitable terms is essential. Legal advisors can help structure the investment in a way that protects the company’s long-term interests while satisfying investor demands.

Advisory Boards: Creating an advisory board with representatives from different investor groups can help mediate conflicts, provide strategic advice, and ensure that the company’s growth trajectory aligns with the expectations of all stakeholders.

Long-Term Implications

While full ratchet provisions offer short-term protection for early investors, they can have significant long-term implications for a company’s valuation, capital structure, and investor relations.

Impact on Company Valuation:

Inflated Valuations: The pressure to avoid triggering full ratchet provisions can lead companies to pursue higher valuations in subsequent rounds, even if these valuations are not supported by the company’s financial performance. This can create an unsustainable valuation bubble, making the company vulnerable to future down rounds.

Challenges in Raising Future Capital: The presence of full ratchet provisions can deter new investors, particularly if the company’s valuation is at risk of decline. Potential investors may be wary of the dilution risks associated with full ratchet provisions and may demand significant concessions or avoid the investment altogether.

Long-Term Investor Relations:

Investor Trust and Confidence: Over time, the rigid protection offered by full ratchet provisions can erode trust and confidence among new investors if they perceive the terms as unfair. This could lead to a strained relationship with the investor community, making it harder for the company to secure supportive capital in future rounds.

Potential for Investor Conflict: If full ratchet provisions lead to significant dilution for new investors, the resulting conflicts can disrupt the company’s governance and decision-making processes. Managing these conflicts requires careful navigation and a focus on aligning the interests of all investor groups.

Effect on Company Growth and Strategic Direction:

Stifling Growth Opportunities: The restrictive nature of full ratchet provisions may limit the company’s strategic options, particularly if the need to protect early investors outweighs the company’s ability to pursue new growth opportunities. This could result in missed opportunities or the company being forced to accept less favorable terms in future financing rounds.

Exit Strategies: Full ratchet provisions can complicate exit strategies, such as mergers or acquisitions, if they significantly alter the equity distribution among shareholders. Potential buyers or partners may be hesitant to engage with a company that has a complex capital structure due to these provisions.

Strategically deploying full ratchet provisions requires a nuanced understanding of their benefits and drawbacks. While they offer robust protection for early investors, they can also introduce significant challenges for a company’s long-term growth, valuation, and investor relations. Entrepreneurs must carefully consider the broader implications when negotiating these terms, ensuring that they strike a balance between securing early capital and maintaining flexibility for future fundraising. By proactively managing potential conflicts between investor groups and considering alternative anti-dilution mechanisms, companies can foster a more cohesive investment environment that supports sustainable growth and long-term success.

Conclusion

Summary of What Full Ratchet Provisions Are and How They Protect Investors from Share Dilution:

Full ratchet anti-dilution provisions are powerful tools in the venture capital landscape, designed to protect early investors from the adverse effects of share dilution in subsequent funding rounds. When a company issues new shares at a price lower than what earlier investors paid, full ratchet provisions adjust the conversion price of these investors' shares downward to match the new, lower price. This ensures that the ownership percentage of early investors remains effectively unchanged, even as the company raises additional capital at a reduced valuation.

By recalibrating the conversion price to the lowest price at which new shares are issued, full ratchet provisions offer maximum protection against dilution. This mechanism is particularly valuable in scenarios where a company's valuation decreases between funding rounds—a situation that can significantly erode the value of an investor’s equity stake if no anti-dilution protection is in place.

However, while full ratchet provisions are highly effective in safeguarding early investors, they come with significant trade-offs, particularly in how they impact the company’s future fundraising capabilities and relationships with new investors.

Review of the Strategic Considerations for Both Entrepreneurs and Investors:

For entrepreneurs, the decision to include full ratchet provisions in investment agreements requires careful strategic consideration. While these provisions may be necessary to attract early-stage capital, they can complicate future fundraising efforts. Entrepreneurs must weigh the immediate benefits of securing investment against the potential long-term challenges, such as investor conflict, reduced company valuation, and limited flexibility in subsequent funding rounds.

Key considerations for entrepreneurs include:

Impact on Future Fundraising: Full ratchet provisions can deter new investors due to the potential for significant dilution. Entrepreneurs need to anticipate these challenges and be prepared to negotiate terms that balance investor protection with the company’s growth needs.

Investor Relations: Managing relationships between early and new investors is critical. Entrepreneurs should strive to maintain transparency, communicate openly, and consider structuring investments in a way that minimizes potential conflicts.

Strategic Flexibility: It is essential to retain as much strategic flexibility as possible. Entrepreneurs might consider negotiating for conditional or tiered ratchet provisions or even exploring alternative anti-dilution mechanisms that provide a middle ground.

For investors, particularly those entering early funding rounds, full ratchet provisions are a key negotiating point that can significantly influence their decision to invest. These provisions offer a form of insurance against the risks associated with investing in high-growth, early-stage companies, where valuations can fluctuate dramatically. Investors must, however, be mindful of the broader impact of these provisions on the company’s capital structure and the potential implications for future rounds.

Key considerations for investors include:

Protection vs. Partnership: While protecting their investment is crucial, investors should also consider the long-term health of the company and the importance of fostering a collaborative relationship with the founders and other investors.

Valuation and Exit Strategy: Investors need to understand how full ratchet provisions might affect the company’s valuation and their eventual exit strategy, whether through a sale, merger, or IPO.

Negotiation Leverage: Investors should use their leverage wisely when negotiating full ratchet provisions, ensuring that their demands do not inadvertently harm the company’s ability to grow and attract future capital.

Final Thoughts

Full ratchet provisions offer significant protection for early investors, but their inclusion in investment agreements should not be taken lightly. Both entrepreneurs and investors must carefully evaluate whether this level of protection is necessary and consider the broader implications on the company’s future. Full ratchet provisions can safeguard investor interests effectively, but they can also introduce complexities that may hinder the company’s growth and ability to secure future funding.

It is crucial for all parties involved to thoroughly assess the company’s current and future financial landscape, as well as the potential risks and rewards associated with full ratchet provisions. Entrepreneurs should seek advice from legal and financial experts to fully understand the impact of these provisions and to explore potential alternatives that might better suit the company’s long-term goals.

Encouragement to Consider Alternative Anti-Dilution Provisions Depending on the Company’s Needs and the Investment Context:

Given the potential downsides of full ratchet provisions, it is advisable for both entrepreneurs and investors to consider alternative anti-dilution mechanisms that might offer a more balanced approach. Weighted average provisions, both narrow-based and broad-based, provide viable alternatives that still protect investors but with less severe consequences for new shareholders and the company’s equity structure.

Weighted Average Provisions: These alternatives adjust the conversion price based on a formula that considers the price and quantity of new shares issued, providing a more moderate level of protection. Broad-based provisions, in particular, offer a balanced approach that considers the entire capital structure, making them a preferred choice in later-stage investments.

Conditional or Tiered Provisions: Entrepreneurs and investors might also explore conditional or tiered ratchet provisions that activate only under specific circumstances, such as significant valuation drops. These provisions can offer protection while preserving flexibility for future rounds.

Tailoring Provisions to Context: The choice of anti-dilution mechanism should be tailored to the specific context of the investment, including the company’s stage of development, market conditions, and the strategic goals of both the founders and investors.

In conclusion, while full ratchet provisions are a powerful tool in protecting early investments, their use should be carefully considered within the broader context of the company’s growth trajectory and investment strategy. By weighing the benefits and potential drawbacks, and by considering alternative mechanisms, both entrepreneurs and investors can make informed decisions that support the long-term success of the venture.

Now let’s take a look at the latest funding rounds, and M&A deals as well as the latest articles and videos worth reading and watching.